Which of the Following Are Included in Compensation of Employees

Are the following items part of compensation of employees. Employees contribution to social security schemes are not included in compensation of employees whereas wages and salaries in cash and windfall gains are included in compensation of employees.

What Is Compensation Compensation Meaning And List Of Allowances

91 Which of the following is included in compensation of employees part of the income approach to measuring GDP.

. It refers basically to the total gross wages paid by employers to employees for work done in an accounting period such as a quarter or a year. Pages 16 This preview shows page 6 - 10 out of 16 pages. Basic wage is a stable wage paid over a period of time which could be on a monthly weekly or daily basis.

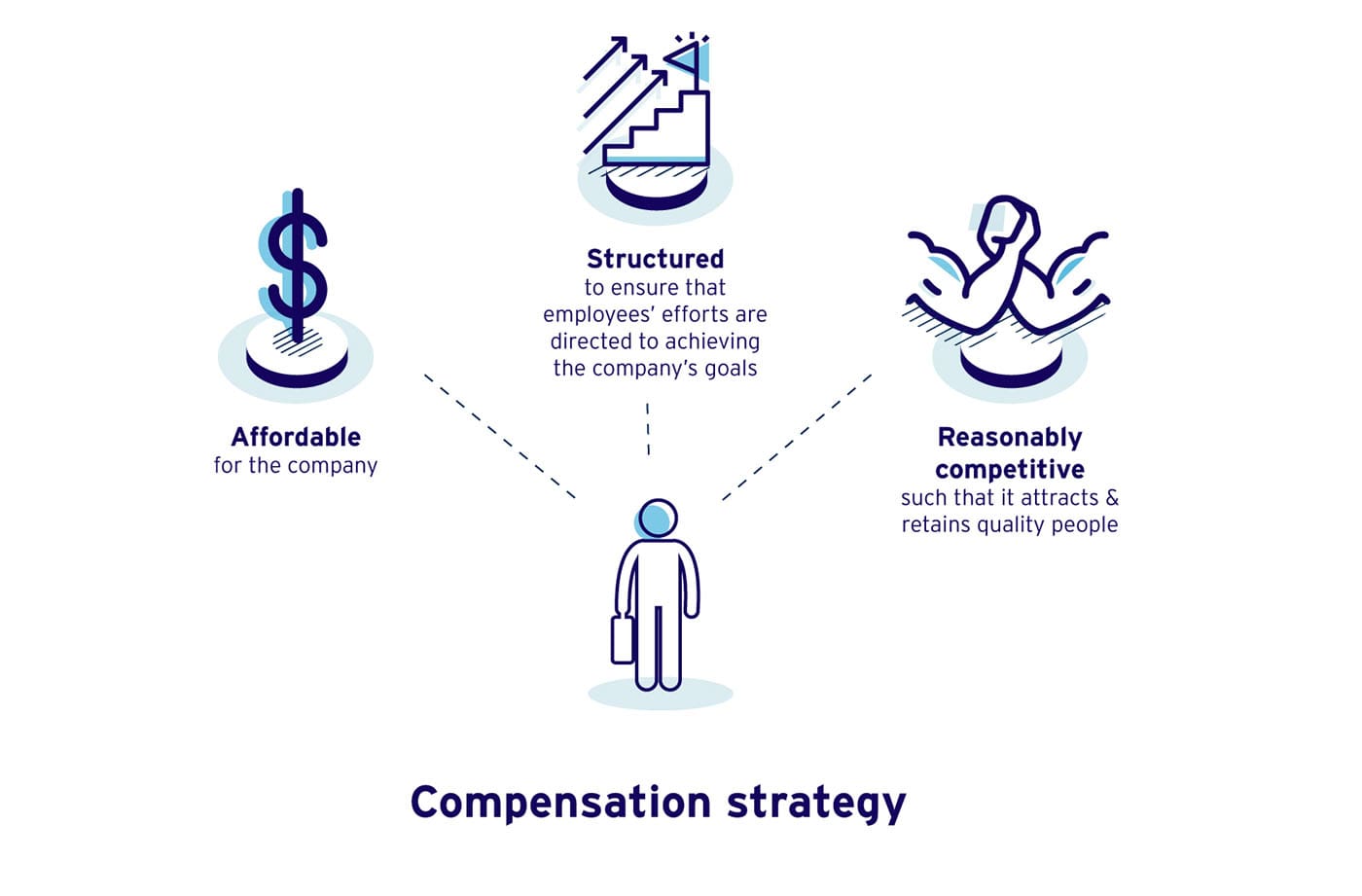

A I only B I and II C I and III D I II and III 92 When calculating the compensation of employees part of GDP. The compensation strategy must be affordable structured and reasonably competitive. Payment by insurance company to an injured employee D.

Iii Rent received by an Indian resident from Russian embassy in India. Tools given to employees to be used during work C. Which of the following is included in compensation of.

View the full answer. It includes the basic pay dearness allowance which is the amount required for the basic consumption and commission if any. Which of the following items is part of compensation of employees.

These types of pay are included in the employees total compensation. Ii Employers contribution to gratuity fund of the employees. It is paid by the employers in a given accounting period.

Because Dearness allowance is a cost of living adjustment allowance paid to government employees public sector employees and pensioners and is calculated as a percentage of basic salary to mitigate the impact of inflation. A An employee with pneumonia B An employee who sustained a crushing injury to the leg at work C An employee who is having surgery for gallbladder disease D An employee who takes insulin for diabetes E An employee who is on maternal leave. Compensation of employees is a statistical term used in national accounts balance of payments statistics and sometimes in corporate accounts as well.

D 52-Which of the following factor influences employee compensation. I Entertainment allowance to an employee to entertain business guests. It includes the basic pay dearness allowance which is the amount required for the basic consumption and commission if any.

Iii Employees contribution to provident fund. Which of the following is included in compensation of employees part of the 6. Ii Payment of fees to a Chartered Accountant by a firm.

Compensation of employees refers to the total gross waged paid to the employees for the work done by them. An employees base pay does not include compensation that might raise the wages above the base level. So it is included in compensation of employees.

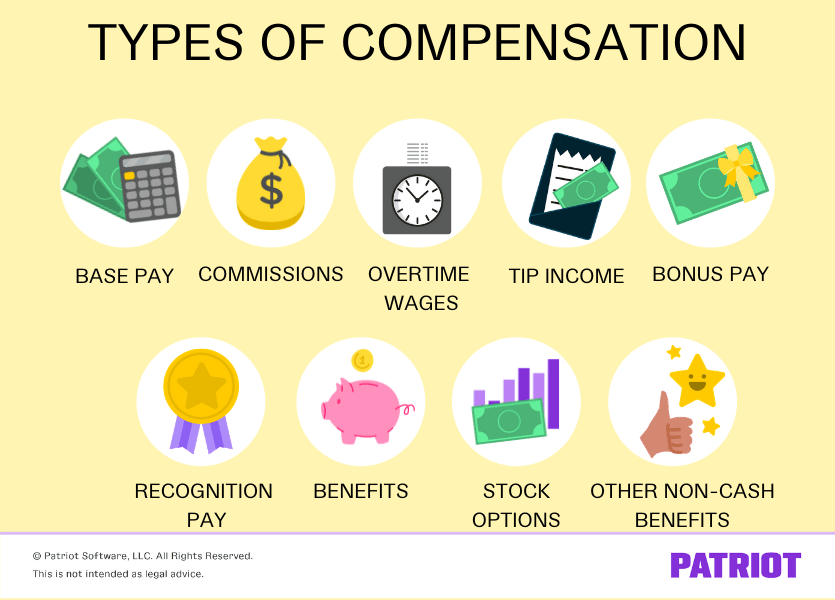

Course Title ECO 2104. Basic Wages Dearness Allowance Bonus and Allowances The major components or constituents of employee compensation may include the following. Which of the following is included in compensation of employees part of the income approach to measuring GDP.

School INTI International University. I Entertainment allowance to an employee to entertain business guests. Which of the following employees would qualify for workers compensation.

51-The remuneration system needs to meet the following types of equity a. I Compensation of employees to residents of Japan working in Indian embassy in Japan. Compensation of employees refers to the payment which an employee gets against the output generated by hum in the firm.

Iv Payment of claim of insurance claim by LIC to the injured worker. Time Atten 47M Question 31 01 pts ces ations Which of the following is included in compensation of employees part of the income approach to measuring GDP. Select all that apply Which of the following are included in compensation of employees.

Employee Compensation 4 Major Components. Which of the following is included in compensation of employees. All of the above Ans.

Check all that apply-Payments by employees into private pension plans-Wages and salaries-Payments by employers into private pension plans for employees-Payments by employers into social insurance for. Wages and salaries II. I Compensation of employees to the residen of Japan working in Indian embassy in Japan.

Contribution by employee to provident fund. Employees contribution to social security schemes are not included in compensation of employees whereas wages and salaries in cash and windfall gains are included in compensation of employees. It is paid by the employers in a given accounting period.

Ii Profits earned by a branch of foreign bank in India. A Compensation of employees refers to the payment which an employee gets against the output generated by hum in the firm. Payments by employers into social insurance for employees Wages and salaries O Payments by employees into private pension plans Payments by employers into private pension plans for employees.

Iv Payment of claim of insurance claim by LIC to the injured worker. Give reasons for your answer. It may include base salary wages incentives andor commission.

Ii Employers contribution to gratuity fund of the employees. Defining a compensation strategy is an important activity for all companies including startups. Iii Rent received by an Indian resident from Russian embassy in India.

However in reality the aggregate includes more than just gross wages at least in. Iv Compensation given by. Cost of living c.

Will the following factors income be included in domestic factor income of India. All of the above Ans. Give reasons for your answer.

Total compensation includes cash rewards as well as any other company benefits. Iii Employees contribution to provident fund. Which of the following are included in compensation of employees.

D 53-Match the following Business strategy Compensation. Compensation of employees 4080 Corporate profits 134 Corporate profits taxes 23 Rental income 31 Capital consumption allowance 295 Indirect business taxes 130 Net interest 147 Exports 300 Imports 320 Undistributed corporate profits 111 Transfer payments 66 Personal taxes 45 Dividends 0 Income Earned from the Rest of the World 252. For example bonuses overtime and commissions are not part of base pay.

Rse Evalu- Resources I only Discover I and II am Matrix I and III 111 and III - Previous Next. C Compensation of employees refers to the total gross waged paid to the employees for the work done by them.

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

Employee Compensation And Benefits Template Total Rewards Etsy Compensation Excel Templates Employee

What Benefits Do Your Employees Want Infographic Employee Benefits Infographic Management Infographic Infographic

No comments for "Which of the Following Are Included in Compensation of Employees"

Post a Comment